Generating Bills for Monthly/Retainer Fee matters

In this guide, you will learn, through the Monthly/Retainer Fee tab, how to automatically generate invoices for matters with this billing strategy.

Table of contents

Accessing the Monthly/Retainer Fee tab

To enter the Monthly/Retainer Fee tab:

- Access the Billing window by clicking the Billing (

) link on the left side panel.

) link on the left side panel. - Click the Monthly/Retainer Fee tab.

From the Monthly/Retainer Fee tab you can select:

- Any, many, or all billable matters.

- All matters for a specific Client or any required combination by using the filter panel.

After making your selection, click the Generate button.

In the Generate Bills panel, fill in the fields and sections as follows:

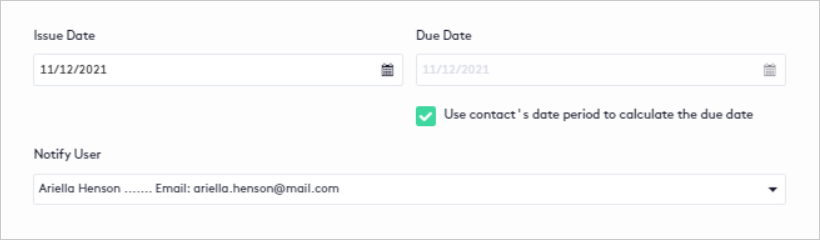

- The Issue Date and Due Date fields will be the current date by default, but can be modified and will apply to all generated invoices.

- If you change the Issue Date but still want the Due Date to respect the grace period specified in client payment profiles, make sure the Use contact’s grace period to calculate the due date box is checked.

See the following guides or tutorials for more information:

- Getting started with Contacts to know how to establish a client’s payment profile.

- Managing Payment Profiles to know how to create a new payment profile and establish grace periods.

- Notify User: Select a user to be notified via email and/or in the app when the bills are generated. Notifications will be displayed based on the user’s profile settings.

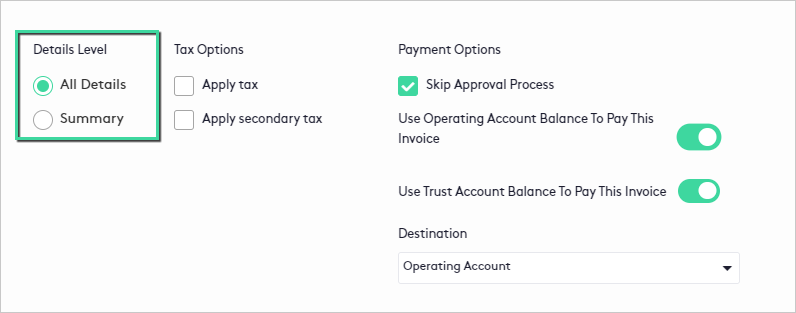

Setting the Details Level

This section defines how the activities will be organized in the invoices to be generated:

- All Details: This method shows each activity in association with a particular bill as a separate line item.

This billing option is ideal for providing accuracy and transparency to clients with the largest number of bills.

- Summary: This method condenses the activities by type, showing only the types and their amount.

This billing option is suitable to provide clients with a distribution of the amount allocated by type, without losing conciseness and simplicity.

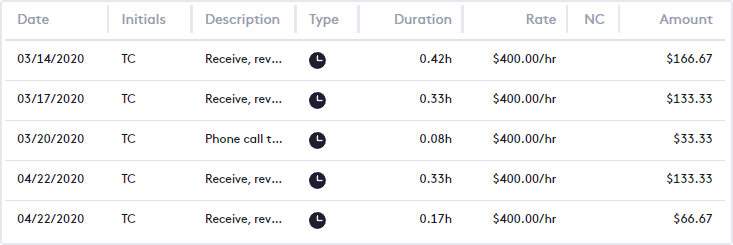

The activities are visible in the Invoice Details window and the downloaded PDF:

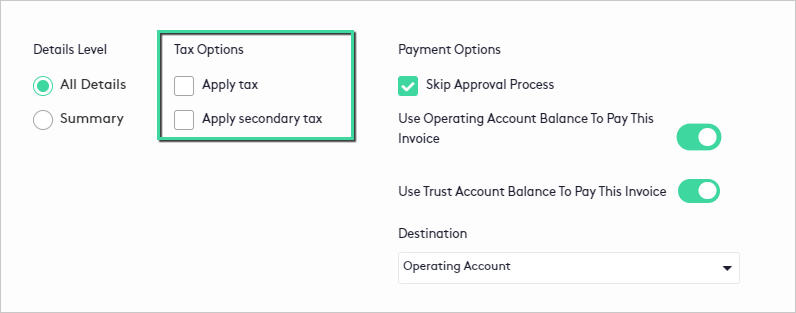

Setting Tax Options

A tax and/or a secondary tax will be applied to the bill total by checking the respective boxes. Tax rates will be applied according to those established in the Manage Firm settings.

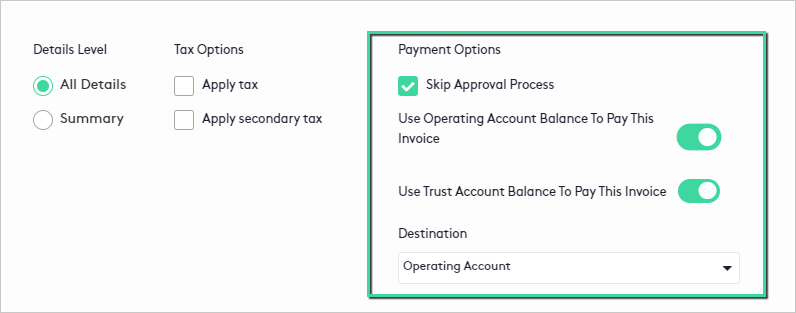

Configuring Payment Options

From this section you can automatically move all bills to Approved status and pay them if funds are available:

- The Skip Approval Process box will be checked by default. By unchecking the box, all bills will be saved in the Draft state and cannot be paid.

- To execute invoice payments, you can select one or both of the available options and then select a Destination (Operating accounts only) where the funds will be deposited.

The order that Maatdesk follows to make the payment of each invoice is shown below:

- Maatdesk will attempt to use Available Matter Funds (for bill-related matters) in Operating Accounts to cover the invoice balance.

- If the balance is not covered, Maatdesk will attempt to use Available Client Funds in Operating Accounts to cover the invoice balance.

- Maatdesk will attempt to use Available Matter Funds (for bill-related matters) in Trust Accounts to cover the invoice balance.

- If the balance is not covered, Maatdesk will attempt to use Available Client Funds in Trust Accounts to cover the invoice balance.

- If the balance is fully or partially covered, Maatdesk will automatically record the payment. The remaining payments (or all if the balance was not covered) must be recorded manually when the client makes them.

Once you have finished configuring all the parameters, click the Generate button.

For each selected matter:

- A Flat Fee activity will be created in Billed status with the description “Recurrent Fee related to DATE” and the user (Biller) specified when creating/editing the matter will be the one who bills it. (DATE corresponds to the month to be invoiced).

- An invoice will be created for said activity, its status and the completion of the payment will depend on the above options and conditions.

Related guides or tutorials

- Getting started with Billing.

- Getting Started with Matters.

- Generating Bills for Billable Clients.

- Understanding Billing module.

- Understanding Invoice statuses.